The cryptocurrency market continues to attract investors seeking opportunities. Among the rising solutions, Euro Capital presents itself as an accessible automated trading platform. This concise analysis gives you the key elements to calmly assess its value proposition.

At-a-glance summary table

| Key features of Euro Capital | |

|---|---|

| Platform name | Euro Capital |

| Platform type | Web-based automated trading |

| Technology used | Artificial intelligence and advanced algorithms |

| Minimum deposit | $250 |

| Available assets | Cryptocurrencies, stocks, forex, commodities, bonds |

| Platform fees | No sign-up fees, free deposits and withdrawals |

| Withdrawal time | 24 to 48 hours |

| Advertised success rate | 96% |

| Customer support | 24/7 |

| Compatibility | Desktop, tablet, mobile |

| User rating | 4.7/5 |

| Account verification | Required for security |

What is Euro Capital and how the platform works

Euro Capital represents a new generation of platforms designed to democratize access to markets, particularly cryptocurrencies. The idea is to offer a simple experience for beginners, with tools robust enough for advanced users.

The principle of automated trading

At the heart of Euro Capital is an automated trading engine that relies on artificial intelligence. It continuously analyzes market movements to identify opportunities without constant manual intervention.

The system scans numerous real-time data points, from price changes to volumes, integrating signals that influence trends. This rapid reading helps spot patterns that are hard to see with the naked eye.

An AI that improves over time

Euro Capital’s technology learns from its decisions to adjust strategies. The algorithms evaluate past outcomes and optimize future executions.

The goal is to remain effective despite changing market conditions. The platform displays an estimated success rate of 96% according to its data.

How to get started with Euro Capital step-by-step guide

The sign-up flow is designed to be smooth. Here are the essential steps.

Create your user account

Go to the official Euro Capital website and complete the form. Enter your name, email, and phone number. Sign-up is free and quick.

Verify and secure your account

Identity verification is required to activate the account. Provide an official ID and confirm your phone number. This step contributes to security and compliance.

Deposit initial capital

After validation, fund your account. The minimum deposit is $250. Common payment methods are supported.

Configure trading preferences

Before going live, adjust your settings. Daily limits, risk level, stop-loss orders, and asset choices allow you to align the system with your strategy.

Activate automated trading

Once ready, turn on trading. Euro Capital analyzes the market continuously and executes orders according to your settings.

Is Euro Capital legitimate

Legitimacy is central in crypto. Several elements help assess Euro Capital’s credibility.

Indicators of reliability

The sign-up process is clear and avoids excessive data collection. Identity verification follows industry standards.

Pricing is straightforward. No hidden fees on deposits, withdrawals, or transactions, according to the information provided.

Security measures and protection

Euro Capital announces bank-level encryption to secure data and exchanges. Operations use SSL protocols.

Withdrawals are reported as fast, between 24 and 48 hours based on available feedback.

User feedback

Reviews mention an average rating around 4.7 out of 5, with frequent comments on simplicity, responsive support, and withdrawal speed.

Important note

Even with favorable signals, any investment carries risk. Only invest money you can afford to lose and conduct your own checks.

Pros and cons of Euro Capital

An overview of strengths and points to consider.

Major advantages

- Quick sign-up in a few minutes

- No hidden fees or transaction commissions

- Accessible $250 minimum deposit

- Wide selection of popular cryptocurrencies

- Automation with continuous monitoring

- Customizable risk management parameters

- Support available 24/7 via chat and email

- Withdrawals processed within 24 to 48 hours

- Mobile, tablet, and desktop compatibility

- User-friendly interface for beginners

- Access in many countries

- Identity verification for security

- Transparency about fund management

- Ability to explore settings before going live

Points to consider

- Unavailable in certain strict jurisdictions (Cyprus, Iran, Israel)

- Requires a stable internet connection

- Slight learning curve for advanced options

Costs, minimum investment, and potential

Financial accessibility is one of Euro Capital’s strengths. The platform avoids high entry barriers.

Transparent fee structure

Sign-up is free. No fees on deposits or withdrawals according to the provided information. No hidden commissions.

You therefore keep all your profits, unlike other platforms that may charge percentages on every trade.

Starting capital and a cautious approach

The minimum to start on Euro Capital is $250. This threshold makes onboarding easier.

Consider this amount as a test. Take time to explore the platform, then increase gradually if the results suit you.

Cautionary advice

Even with an advertised 96% success rate, no system guarantees constant profits. Crypto remains volatile. Diversify and never invest essential funds.

Cryptocurrencies and available assets

Asset variety is a key criterion. Euro Capital offers major cryptocurrencies and other asset classes.

Main supported cryptocurrencies

Bitcoin (BTC)

The first and largest cryptocurrency

Ethereum (ETH)

Leading smart contract platform

Ripple (XRP)

Cross-border payments solution

Litecoin (LTC)

Fast alternative to Bitcoin

Bitcoin Cash (BCH)

Optimized Bitcoin fork

Cardano (ADA)

Third-generation blockchain

Solana (SOL)

High-performance blockchain

Dogecoin (DOGE)

Popular community cryptocurrency

USD Coin (USDC)

Dollar-backed stablecoin

ChainLink (LINK)

Decentralized oracle network

Uniswap (UNI)

Leading decentralized exchange

TRON (TRX)

Decentralized content platform

This selection covers liquid and recognized assets, from Bitcoin to Ethereum, with a stablecoin like USDC for relatively more stability.

Beyond crypto multi-asset diversification

Euro Capital also enables trading of forex pairs, stocks, commodities, bonds, and certain derivatives.

This multi-asset approach helps build a more diversified portfolio within a single interface.

Geographic availability where to use Euro Capital

Euro Capital aims for broad coverage while complying with local regulations.

Broad international coverage

United States

Canada

United Kingdom

Germany

France

Spain

Belgium

Netherlands

Switzerland

Norway

Sweden

Finland

Denmark

Poland

Slovakia

Slovenia

Australia

Japan

Singapore

Hong Kong

Taiwan

Thailand

Vietnam

Malaysia

Brazil

Chile

Mexico

South Africa

The platform is accessible in most countries where crypto trading is permitted.

Restrictions to know

Restrictions exist depending on national laws. Currently, Euro Capital is not available in countries such as Cyprus, Iran, and Israel.

Before signing up, check that your country is eligible. Support can confirm if needed.

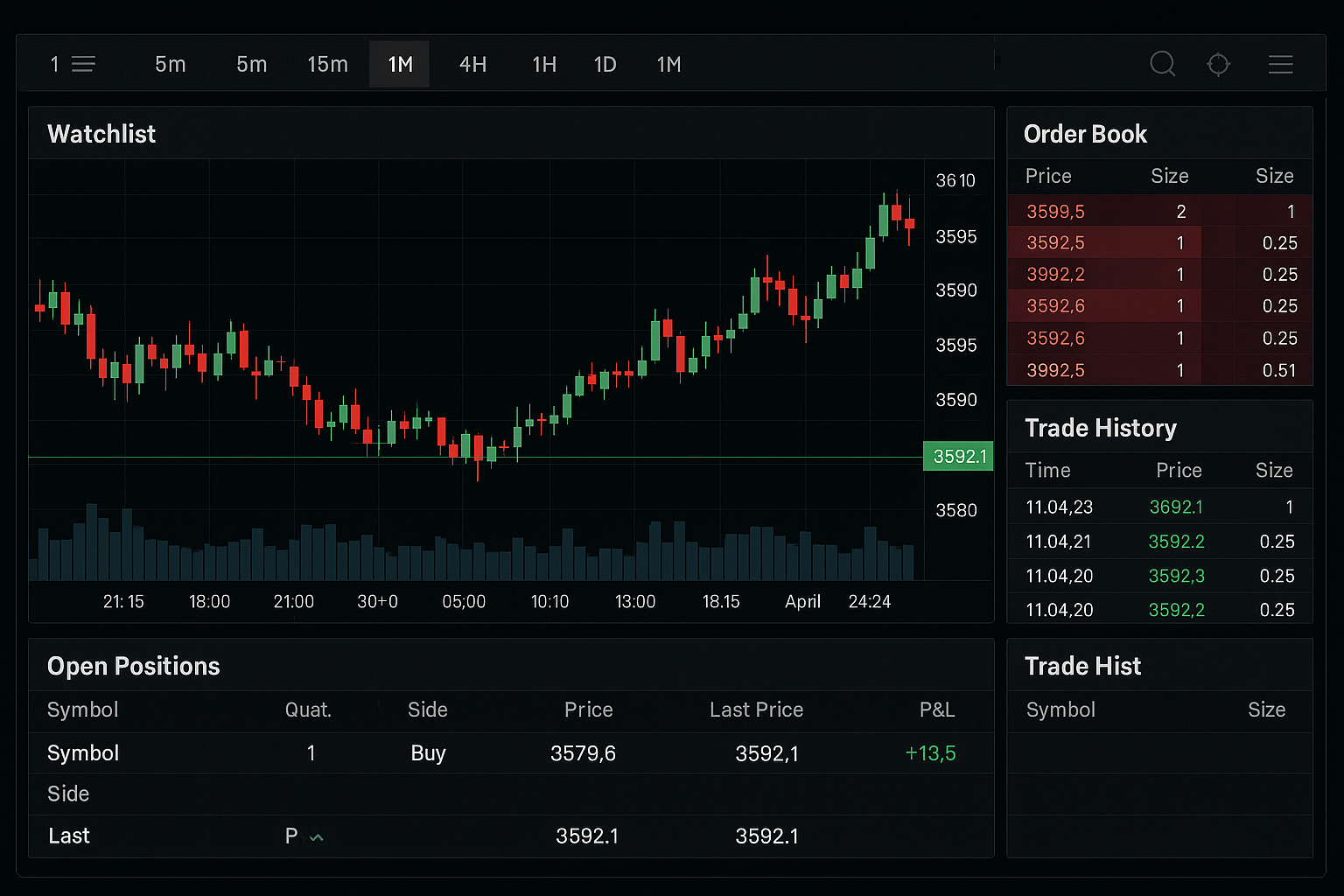

Interface and trading experience

Ergonomics matter a lot for progressing quickly on a platform.

A design for everyone

A clear dashboard for essentials. For advanced users, quick access to charts, indicators, settings, and analysis tools.

Multi-platform accessibility

Web-based solution. No installation required. Access your account from any device with a modern browser.

Customer support and guidance

Support quality weighs heavily in evaluating a platform.

Availability and channels

Euro Capital offers 24/7 support via chat and email. Users report quick responses in chat and within 24 hours by email.

Resources to grow

Guides, tutorials, and educational content support onboarding and risk management.

Security and data protection

Security mechanisms are essential for any online financial service. Euro Capital highlights multiple layers of protection.

Encryption and secure transactions

Exchanges are reported to be protected by SSL encryption. Transactions undergo authenticity checks before execution.

Identity verification and fraud prevention

The KYC process helps secure the ecosystem and limits abuse. It also protects access to your account.

Withdrawals speed and transparency

A service’s quality also shows in the ease of withdrawing funds.

Processing times

Withdrawal requests are reported to be processed within 24 to 48 hours after validation.

No withdrawal fees

The platform indicates it does not charge for withdrawals, allowing you to recover the full amount transferred.

Built-in risk management

Crypto volatility requires safeguards. Euro Capital offers several mechanisms.

Capital protection

Configuration of stop-loss orders to limit losses and take-profit orders to secure gains.

Customizable limits

Ability to set daily caps to control exposure.

Final verdict Euro Capital deserves your attention

⭐⭐⭐⭐⭐ 4.7/5 (Average user rating)

Given the presented elements, Euro Capital appears to be a simple-to-use automated trading solution, with a $250 deposit and pricing announced without hidden fees.

The AI components, available support, and reportedly fast withdrawals strengthen the case for testing the platform in real conditions.

To begin, take a measured approach. Start with the minimum, check your settings, and never invest beyond your risk tolerance.

Frequently asked questions about Euro Capital

How long does it take to open an account

The initial form takes less than 5 minutes. Identity verification may take a bit longer depending on document processing.

Are there any hidden fees

According to the provided information, Euro Capital does not apply hidden fees on sign-up, deposits, trading, or withdrawals.

Can I customize my trading parameters

Yes. You can set daily limits, adjust risk tolerance, enable stop-loss and take-profit, and choose your assets.

On which devices can I use Euro Capital

The solution is web-based and works on computer, tablet, and smartphone via a recent browser.

Is support available around the clock

Yes, a 24/7 customer service is announced, reachable via chat and email.

What is the minimum deposit

The minimum required to activate live trading is $250.

How long does a withdrawal take to arrive

Requests are reported to be processed within 24 to 48 hours after validation. Final receipt also depends on your financial institution.

Is the platform accessible from France and Europe

Yes, Euro Capital is accessible in most European countries, subject to local regulations.

Can I try it before committing real money

You can explore the interface and configure your settings before enabling live mode. This helps you get familiar with the platform before trading with your initial deposit.

Which cryptocurrencies can I trade

Euro Capital supports notably BTC, ETH, XRP, LTC, BCH, ADA, SOL, DOGE, USDC, LINK, UNI, and TRX. The platform also offers other asset classes such as forex, select stocks, and commodities.

Disclaimer: Trading cryptocurrencies and other financial assets involves risk of loss. Past performance does not predict future results. Only invest funds you can afford to lose. This content is informational and not financial advice. Do your own due diligence and, if needed, consult a qualified professional.