The cryptocurrency market continues to attract investors looking for opportunities. Among the rising solutions, Trésor Tradevia presents itself as an accessible automated trading platform. This concise analysis gives you the key elements to calmly evaluate its value proposition.

One-glance summary table

| Key features of Trésor Tradevia | |

|---|---|

| Platform name | Trésor Tradevia |

| Platform type | Web-based automated trading |

| Technology used | Artificial intelligence and advanced algorithms |

| Minimum deposit | $250 |

| Available assets | Cryptocurrencies, stocks, forex pairs, commodities, bonds |

| Platform fees | No signup fees, free deposits and withdrawals |

| Withdrawal time | 24–48 hours |

| Claimed success rate | 96% |

| Customer support | 24/7 |

| Compatibility | Desktop, tablet, mobile |

| User rating | 4.7/5 |

| Account verification | Required for security |

What is Trésor Tradevia and how the platform works

Trésor Tradevia represents a new generation of platforms designed to democratize access to markets, especially cryptocurrencies. The idea is to offer a simple experience for beginners with tools robust enough for advanced profiles.

The principle of automated trading

At the core of Trésor Tradevia is an automated trading engine powered by artificial intelligence. It continuously analyzes market movements to identify opportunities without constant manual intervention.

The system scans numerous real-time data points—from price changes to volumes—integrating signals that weigh on trends. This rapid reading helps spot patterns that are hard to see with the naked eye.

An AI that improves over time

Trésor Tradevia’s technology learns from its decisions to adjust strategies. The algorithms evaluate past outcomes and optimize future executions.

The goal is to remain effective as market conditions evolve. The platform displays a reported success rate of 96% according to its data.

How to get started with Trésor Tradevia step by step

The signup flow is designed to be smooth. Here are the essential steps.

Create your user account

Go to the official Trésor Tradevia website and complete the form. Enter your name, email, and phone number. Registration is free and quick.

Verify and secure your account

Identity verification is required to activate the account. Provide a valid ID and confirm your number. This step contributes to security and compliance.

Deposit initial capital

After approval, fund your account. The minimum deposit is $250. Common payment methods are supported.

Configure your trading preferences

Before going live, adjust your settings. Daily limits, risk level, stop-loss orders, and asset selection let you align the system to your strategy.

Activate automated trading

Once ready, turn on trading. Trésor Tradevia continuously analyzes the market and executes orders according to your configuration.

Is Trésor Tradevia legitimate

Legitimacy is central in crypto. Several elements help assess the credibility of Trésor Tradevia.

Reliability indicators

The signup journey is clear and avoids excessive data collection. Identity verification follows industry standards.

Pricing is straightforward. No hidden fees on deposits, withdrawals, or trades according to the information provided.

Security measures and protection

Trésor Tradevia reports bank-grade encryption to secure data and transactions. Operations use SSL protocols.

Withdrawals are reported as fast, between 24 and 48 hours based on available feedback.

User feedback

Reviews mention an average score around 4.7 out of 5, with frequent praise for simplicity, responsive support, and withdrawal speed.

Important note

Even with favorable signals, every investment carries risk. Only commit money you can afford to lose and conduct your own checks.

Pros and cons of Trésor Tradevia

An overview of strengths and points to consider.

Major advantages

- Quick signup in minutes

- No hidden fees or trading commissions

- Accessible $250 minimum deposit

- Wide selection of popular cryptocurrencies

- Automation with continuous monitoring

- Customizable risk management settings

- Support available 24/7 via chat and email

- Withdrawals processed in 24–48 hours

- Compatibility across mobile, tablet, and desktop

- Beginner-friendly interface

- Access in many countries

- Identity verification for security

- Transparency on fund handling

- Ability to explore settings before going live

Points to consider

- Unavailable in certain strict jurisdictions (Cyprus, Iran, Israel)

- Requires a stable internet connection

- Slight learning curve for advanced options

Costs, minimum investment, and potential

Financial accessibility is among Trésor Tradevia’s strengths. The platform avoids high entry barriers.

Transparent fee structure

Registration is free. No fees on deposits or withdrawals according to provided information. No hidden commissions.

You therefore keep 100% of your gains, unlike other platforms that may charge a percentage on each operation.

Starting capital and cautious approach

The minimum to begin on Trésor Tradevia is $250. This threshold eases onboarding.

Consider this amount a test. Take time to explore the platform, then scale up gradually if the results suit you.

Prudence tip

Even with a reported 96% success rate, no system guarantees consistent profits. Crypto remains volatile. Diversify and never invest indispensable funds.

Cryptocurrencies and available assets

Asset variety is a key criterion. Trésor Tradevia offers major cryptocurrencies and other asset classes.

Main supported cryptocurrencies

Bitcoin (BTC)

The first and largest cryptocurrency

Ethereum (ETH)

Leading smart contract platform

Ripple (XRP)

Cross-border payments solution

Litecoin (LTC)

Fast alternative to Bitcoin

Bitcoin Cash (BCH)

Optimized Bitcoin fork

Cardano (ADA)

Third-generation blockchain

Solana (SOL)

High-performance blockchain

Dogecoin (DOGE)

Popular community-driven cryptocurrency

USD Coin (USDC)

USD-backed stablecoin

ChainLink (LINK)

Decentralized oracle network

Uniswap (UNI)

Leading decentralized exchange

TRON (TRX)

Decentralized content platform

This selection covers liquid, well-known assets from Bitcoin to Ethereum, with a stablecoin like USDC for relative stability.

Beyond crypto: multi-asset diversification

Trésor Tradevia also enables trading in forex pairs, stocks, commodities, bonds, and select derivatives.

This multi-asset approach helps build a more diversified portfolio within a single interface.

Geographic availability where you can use Trésor Tradevia

Trésor Tradevia targets broad coverage while respecting local regulatory frameworks.

Broad international coverage

United States

Canada

United Kingdom

Germany

France

Spain

Belgium

Netherlands

Switzerland

Norway

Sweden

Finland

Denmark

Poland

Slovakia

Slovenia

Australia

Japan

Singapore

Hong Kong

Taiwan

Thailand

Vietnam

Malaysia

Brazil

Chile

Mexico

South Africa

The platform is accessible in most countries where crypto trading is allowed.

Restrictions to know

Restrictions exist depending on national regulations. Currently, Trésor Tradevia is not available in countries like Cyprus, Iran, and Israel.

Before signing up, check eligibility in your country. Support can confirm if needed.

Interface and trading experience

Ergonomics matter for quickly progressing on a platform.

A design for everyone

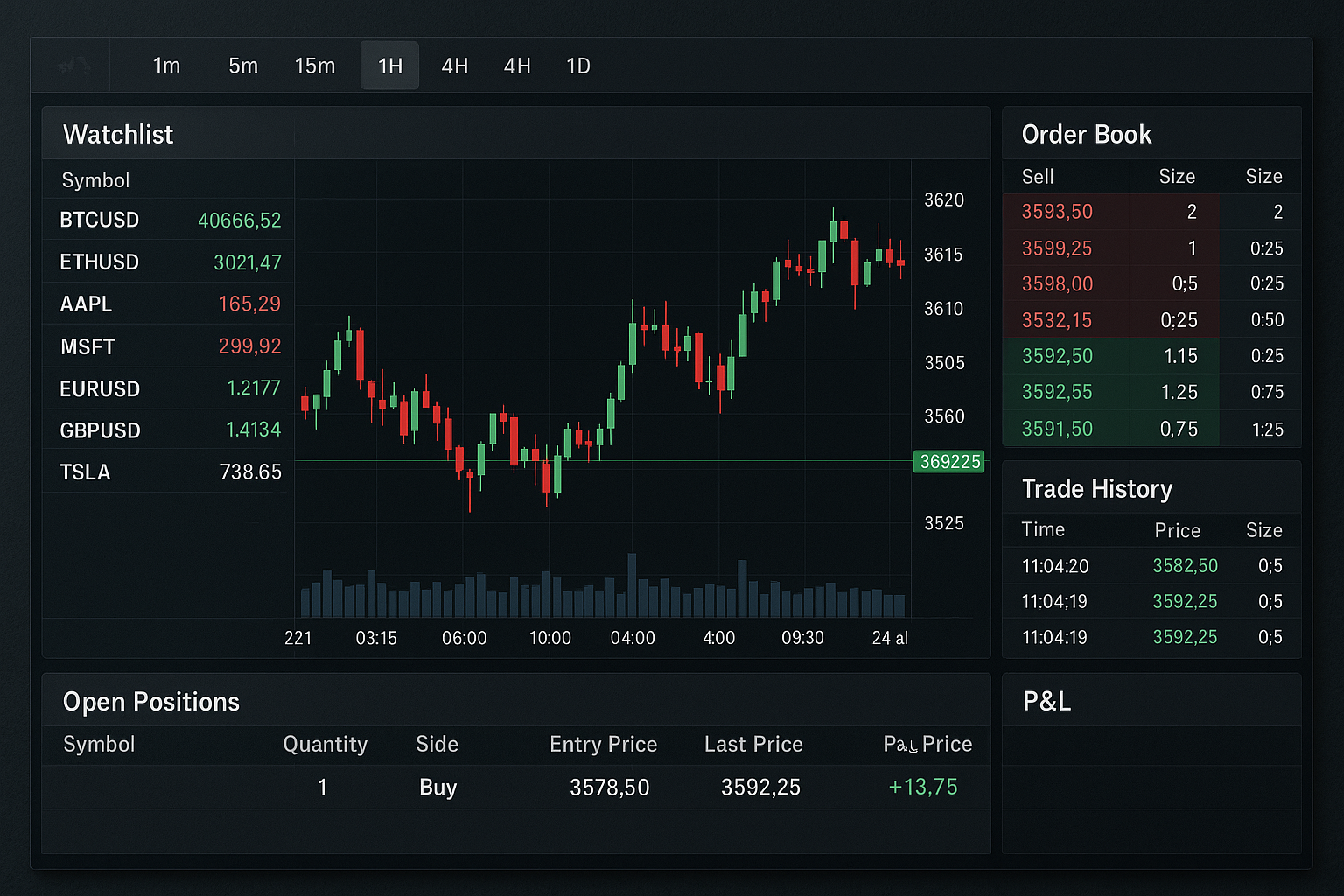

A clear dashboard for essentials. For advanced users, quick access to charts, indicators, settings, and analysis tools.

Multi-platform accessibility

Web-based solution. No installation required. Access your account from any device with a modern browser.

Customer support and guidance

Support quality weighs heavily in evaluating a platform.

Availability and channels

Trésor Tradevia offers 24/7 support via chat and email. Users report fast chat responses and under-24-hour replies by email.

Resources to progress

Guides, tutorials, and educational content support onboarding and risk management.

Security and data protection

Security mechanisms are essential for any online financial service. Trésor Tradevia highlights multiple protection layers.

Encryption and secure transactions

Exchanges are said to be protected by SSL encryption. Transactions go through authenticity checks before execution.

Identity verification and fraud prevention

The KYC process helps secure the ecosystem and limits abuse. It also protects access to your account.

Withdrawals speed and transparency

A service’s quality also shows in how easy it is to withdraw funds.

Processing times

Withdrawal requests are reported to be processed within 24 to 48 hours after approval.

No withdrawal fees

The platform indicates it does not charge withdrawal fees, allowing you to receive the full transferred amount.

Built-in risk management

Crypto volatility requires safeguards. Trésor Tradevia offers several mechanisms.

Capital protection

Configure stop-loss orders to limit losses and take-profit orders to lock in gains.

Customizable limits

Set daily caps to control exposure.

Final verdict Trésor Tradevia deserves your attention

⭐⭐⭐⭐⭐ 4.7/5 (Average user rating)

Given the presented elements, Trésor Tradevia appears to be a simple-to-use automated trading solution with a $250 deposit and an announced fee-free structure.

The AI components, available support, and reportedly fast withdrawals strengthen the case for testing the platform in real conditions.

To begin, take a measured approach. Start with the minimum, check your settings, and never invest beyond your risk tolerance.

Frequently asked questions about Trésor Tradevia

How long does it take to open an account

The initial form takes under 5 minutes. Identity verification may take longer depending on document processing.

Are there any hidden fees

According to the provided information, Trésor Tradevia does not apply hidden fees on signup, deposits, trading, or withdrawals.

Can I customize my trading settings

Yes. You can set daily limits, adjust risk tolerance, activate stop-loss and take-profit orders, and choose your assets.

Which devices can I use Trésor Tradevia on

The solution is web-based and works on desktop, tablet, and smartphone via a modern browser.

Is support available around the clock

Yes, 24/7 customer support is reported, reachable via chat and email.

What is the minimum deposit

The minimum required to activate live trading is $250.

How long does a withdrawal take to arrive

Requests are said to be processed within 24 to 48 hours after approval. Final receipt also depends on your financial institution.

Is the platform accessible from France and Europe

Yes, Trésor Tradevia is accessible in most European countries, subject to local regulations.

Can I test it before committing real money

You can explore the interface and configure your settings before enabling live mode. This helps you get familiar before trading with your initial deposit.

Which cryptocurrencies can I trade

Trésor Tradevia supports BTC, ETH, XRP, LTC, BCH, ADA, SOL, DOGE, USDC, LINK, UNI, and TRX. The platform also offers other asset classes like forex, select stocks, and commodities.

Disclaimer: Trading cryptocurrencies and other financial assets involves risk of loss. Past performance does not guarantee future results. Only invest money you can afford to lose. This content is informational and does not constitute financial advice. Do your own research and, if needed, consult a qualified professional.